It all starts with you

We take into consideration a variety of factors like lifestyle and budget, but by listening to you and being deeply familiar with your needs, we can create more possibilities than you ever imagined.

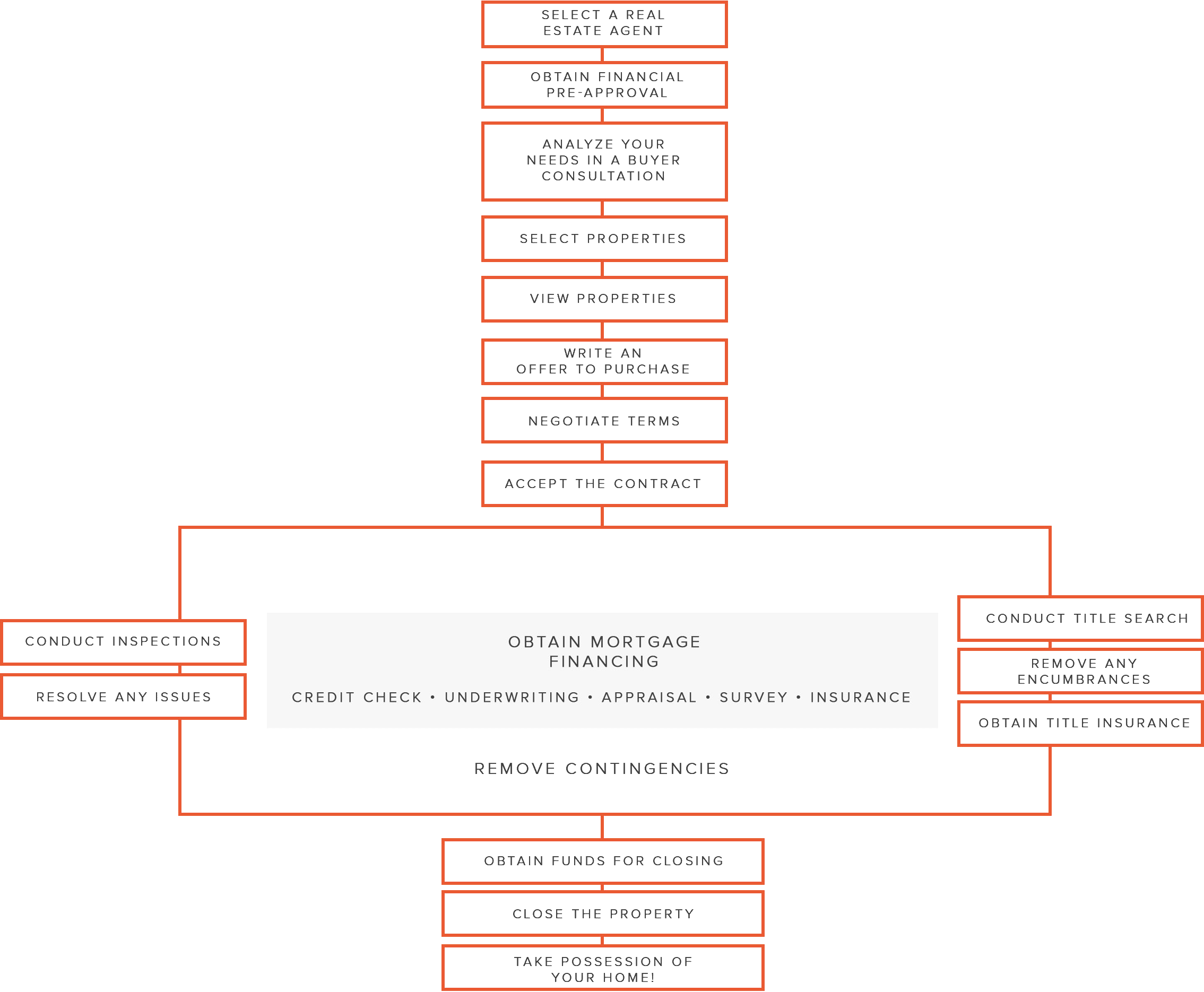

From the search to even after handing over the keys, we can provide the stepping stones to your future. It's your journey and we are proud to be a part of it.

Do you have access to foreclosure lists?

Absolutely, and these days, the best foreclosure deals are here and gone in the first week. The public internet usually only gives access to foreclosures that are overpriced and have been sitting on the market for months. In order to find the best foreclosure deals, you need a team scouring the market for the best deals as soon as they hit the market.

Do I need a Real Estate Agent?

Real estate agents can help you narrow your housing options. The U.S. Department of Housing and Urban Development recommends the use of a real estate agent. Make sure the agent works for you so the agent will be working for your interests. Your agent can take your criteria for a home, including cost, neighborhood, schools, home size and amenities, and match it with the Multiple Listing Service (MLS), which lists all of the homes for sale in a particular area. If you’re purchasing government housing, such as a HUD home, you must have an agent. Remember, finding the property is the least of what an agent does, especially with the internet. Having a good negotiator on your side can still make or break a deal, and is the most important part of getting a “good deal”. This is why it is still so crucial to choose your agent early in the process. You should choose an agent that you believe can negotiate well on any property of interest.

What are lender fees and what should I expect?

Lender fees can range from .5% to 1.5% percent of the purchase price, depending on the rate and program that the buyer is choosing. The buyer usually has options available that can secure them a lower lender fee in exchange for a higher interest rate, and vice-versa.

What is a down payment, and do I need to send this money in right when my offer is accepted?

You are responsible for two upfront costs when you buy a home. First, there is earnest money, which is a small deposit that lets the seller know you’re serious about buying the home. Earnest money can be up to the 3% of the purchase price (eventually going towards your down payment). The second is the down payment, which is a percentage of the cost of the home, that doesn’t need to be sent to escrow until a few days before closing. Lenders have different requirements for down payments. Traditional lenders usually seek a down payment of at least 10%. Lenders backed by the government can seek less, if you qualify. A reputable mortgage lender will help you find a loan program that works best for you.

What Happens at Closing?

Closing is when you sign all of the loan and ownership paperwork and take over the home. At closing you will be responsible for taking care of some costs, including lender's title policy and points to lower the interest rate on your mortgage, along with fees for loan origination, loan applications, appraisals, housing surveys and even your first month of homeowner’s insurance. These costs can be around 1 - 1.25%, and are largely costs related to obtaining your loan. In addition, please remember that during the inspection period you will also need to budget to pay for the inspectors you hire. A general inspection costs around $400 and a budget of $1500 for inspection costs is a good rule of thumb.